India’s India’s Solar Open Access Hits New Highs solar open access market has crossed a historic milestone, surpassing 30 gigawatts (GW) of cumulative installed capacity in 2025.

The segment, driven largely by corporate and industrial demand for clean power, has delivered record additions. Yet recent quarterly data, policy shifts, and grid constraints have prompted experts to caution that growth may slow in the coming months.

What Is Driving the India’s Solar Open Access Hits New Highs Surge?

Solar open access allows commercial and industrial consumers to procure electricity directly from renewable energy generators instead of purchasing exclusively from local distribution companies (DISCOMs). Through long-term power purchase agreements (PPAs), companies can lock in tariffs for 10 to 20 years, reducing exposure to grid price volatility.

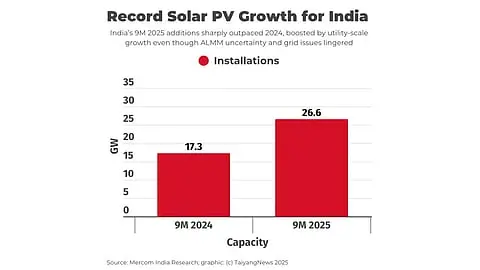

According to industry research firms such as Mercom India, India added approximately 7–8 GW of solar open access capacity in 2025, taking cumulative installations beyond 30 GW. This marks one of the highest annual additions recorded in the segment.

The growth reflects strong demand from sectors including manufacturing, information technology, pharmaceuticals, textiles and data centres. Many companies are under pressure to meet environmental, social and governance (ESG) targets, and open access solar provides a direct route to decarbonisation.

Government policy has also played a role. Transmission charge waivers, supportive state-level regulations, and simplified contracting mechanisms have helped accelerate corporate renewable procurement over the past three years.

However, analysts note that while headline capacity numbers remain impressive, the pace of expansion has moderated.

Quarterly Slowdown Raises Concerns

While annual additions remain robust, industry data shows that quarterly installations slowed towards the end of 2025. The final quarter recorded significantly lower additions compared to mid-year peaks.

Energy market analysts attribute this to several overlapping factors:

- Expiry of certain interstate transmission system (ISTS) charge exemptions

- Project commissioning delays linked to grid approvals

- Rising compliance costs under updated renewable energy regulations

- Tighter financing conditions amid higher interest rates

This deceleration does not indicate contraction, experts say, but it does signal a shift from rapid acceleration to more measured growth.

Grid Infrastructure: The Structural Constraint

Transmission Bottlenecks

India’s grid has expanded significantly in recent years, but infrastructure constraints remain uneven across states. Solar open access projects require reliable evacuation capacity to transmit power from generation sites to corporate consumers.

In regions with congested substations or limited transmission corridors, developers face longer waiting periods for grid connectivity. These delays can increase project costs and affect financial viability.

The Central Electricity Authority (CEA) has repeatedly emphasised the need for accelerated transmission expansion to support renewable integration. Without matching infrastructure upgrades, solar additions may outpace grid readiness.

Integration and Stability Concerns

High renewable penetration can also lead to voltage fluctuations and balancing challenges. While large open access projects typically connect at higher voltage levels, local grid management remains critical.

Experts argue that investments in smart grid technologies, flexible power markets, and battery storage will be necessary to sustain growth in distributed renewable procurement.

Regulatory Uncertainty and State-Level Variations

India’s open access framework is governed by central guidelines but implemented at the state level. As a result, policy execution varies across regions.

Some states have revised open access charges, introduced additional cross-subsidy surcharges, or altered banking provisions for renewable energy. These changes can significantly affect project economics.

Energy policy analysts caution that frequent regulatory adjustments create uncertainty for investors. Long-term PPAs depend on predictable cost structures. Even small revisions in transmission or wheeling charges can reduce expected returns.

Industry associations have urged regulators to ensure policy stability, arguing that predictable rules are essential for sustaining investment flows.

Financing Challenges: Rising Cost of Capital

Solar open access projects are capital-intensive. Developers rely heavily on debt financing to fund construction. With interest rates elevated compared to pre-pandemic levels, the cost of borrowing has increased.

Some lenders are also becoming more selective in underwriting renewable energy projects, focusing on counterparty creditworthiness and regulatory stability.

For smaller developers or projects in states with uncertain policy environments, access to affordable capital has become more difficult.

Green bonds and infrastructure investment trusts (InvITs) have emerged as alternative financing tools. However, these instruments remain concentrated among larger players.

Corporate Demand Remains Strong

Despite emerging headwinds, demand from corporate buyers continues to grow.

Multinational companies operating in India are aligning procurement strategies with global sustainability commitments. Domestic firms are also seeking cost savings amid rising grid tariffs in several states.

According to renewable energy consultants, open access solar tariffs often remain competitive compared to industrial grid tariffs, particularly over the long term.

Data centres, which require large and stable power supplies, have become a significant driver of demand. As India’s digital economy expands, this segment is expected to remain a key growth engine.

Impact on Distribution Companies

The expansion of solar open access also affects state-owned distribution companies. When large consumers shift to direct renewable procurement, DISCOMs lose high-paying customers who often cross-subsidise residential and agricultural users.

Energy economists note that this revenue impact partly explains resistance to open access expansion in some states. Balancing financial sustainability of DISCOMs with renewable growth remains a delicate policy challenge.

Reforms aimed at improving DISCOM efficiency and tariff rationalisation could help ease this tension.

Storage and Hybridisation: The Next Phase

Experts believe that the next growth phase for open access solar may involve hybrid projects that combine solar with wind or battery storage. Hybrid systems can provide more stable power supply profiles, improving reliability for industrial buyers and reducing grid stress.

The central government has introduced policies encouraging renewable hybrid projects. If effectively implemented, these could offset some concerns about variability and integration.

Battery costs, while declining globally, remain relatively high in India. However, falling prices and supportive policy incentives could accelerate adoption.

International Context

India is among the world’s largest renewable energy markets. Its open access framework is often cited as a model for corporate renewable procurement in emerging economies.

Globally, corporate power purchase agreements have grown rapidly, particularly in Europe and North America. India’s progress reflects similar trends but faces unique structural challenges related to grid readiness and state-level regulation.

Comparative studies suggest that policy stability and transparent transmission pricing are critical for sustained corporate renewable growth.

Outlook: Growth, but at a Measured Pace

Industry experts do not predict a collapse in solar open access expansion. Instead, they foresee a transition from rapid scaling to more stabilised growth.

Future additions will likely depend on:

- Faster transmission infrastructure expansion

- Clear and consistent regulatory frameworks

- Improved financing mechanisms

- Integration of storage and hybrid solutions

If these elements align, analysts believe annual additions could remain strong, even if headline growth rates moderate.

Related Links

India’s solar open access market has achieved a landmark milestone by surpassing 30 GW of installed capacity. The segment reflects strong corporate demand and growing commitment to renewable energy procurement.

Yet record capacity alone does not guarantee uninterrupted expansion. Transmission bottlenecks, regulatory changes, financing pressures and utility concerns are reshaping the growth trajectory.

The coming years will test whether policymakers and industry stakeholders can address these structural constraints.

Sustained coordination between regulators, grid operators, financiers and corporate buyers will determine whether India’s India’s Solar Open Access Hits New Highs momentum continues or settles into a slower but steadier path.