Across India, rooftop solar systems are increasingly being described as a financial investment rather than just an environmental upgrade. Industry data show that in many states, solar panels can recover their upfront cost within four to six years, then generate electricity for another 20 years with minimal expense.

This growing narrative — often framed as “better than mutual funds” — is reshaping how households view renewable energy.

Understanding the Solar Panels Pay for Themselves in 4 Years: Solar Panels as a Financial Asset

The comparison between rooftop solar and mutual funds stems from how returns are calculated. When households invest in solar panels, they make a one-time capital expenditure. In return, the system reduces or eliminates monthly electricity bills. The “return” is the money saved over time.

According to India’s Ministry of New and Renewable Energy (MNRE), residential rooftop solar systems typically cost between ₹45,000 and ₹60,000 per kilowatt before subsidy, depending on location and system quality.

A standard 3kW system, common for middle-income homes, may cost approximately ₹1.8 lakh before subsidy. With government support under schemes such as the PM Surya Ghar: Muft Bijli Yojana, announced in 2024, the effective cost can fall significantly.

If such a system saves ₹35,000–₹45,000 annually in electricity expenses, the payback period often falls within 4–6 years. After that, electricity generation effectively becomes free.

The 4-Year Payback: How the Math Works

Let us consider a simplified example.

- System size: 3kW

- Net installation cost after subsidy: ₹1.5 lakh

- Annual electricity savings: ₹40,000

Payback period:

₹1,50,000 ÷ ₹40,000 = 3.75 years

Even with conservative savings of ₹30,000 per year, the payback remains near five years.

After break-even, the system continues operating for 20 years or more. Most solar panels carry a 25-year performance warranty guaranteeing at least 80% output at year 25.

Comparing Solar to Mutual Funds

To understand the “better than mutual funds” claim, one must compare return characteristics carefully.

Mutual Fund Returns

According to data from the Association of Mutual Funds in India (AMFI) and disclosures regulated by the Securities and Exchange Board of India (SEBI):

- Equity mutual funds historically average 10–14% annual returns over long periods.

- Returns are market-linked and volatile.

- Performance depends on fund management and market cycles.

Solar Returns

Solar returns are based on avoided cost — electricity you no longer buy.

In high-tariff states where residential power costs ₹7–₹10 per unit, rooftop solar savings can imply effective returns of 18–25% annually during early years, especially when subsidies reduce capital cost.

Unlike mutual funds:

- Solar savings are not market-dependent.

- Returns are tied to electricity tariffs.

- There is no NAV fluctuation.

However, solar is illiquid. You cannot sell panels instantly like fund units.

Financial planners caution against oversimplified comparisons. “Solar is best viewed as an infrastructure investment for your home, not a trading asset,” says an energy economist at the Indian Institute of Technology (IIT).

Inflation Protection: A Key Advantage

Electricity tariffs in India tend to rise over time due to fuel costs and distribution losses. If tariffs increase by 4–6% annually, solar savings rise proportionally. Mutual funds may or may not beat inflation depending on market cycles.

Solar, by contrast, locks in today’s electricity price for 25 years. This creates what financial analysts describe as a “natural hedge against tariff inflation.”

Net Metering and Additional Earnings

Net metering allows homeowners to export surplus electricity to the grid.

According to MNRE guidelines:

- Excess energy earns credits.

- Credits offset future consumption.

- Some states offer financial compensation.

This reduces effective payback time further.

Policy Push: Government Support Accelerates Adoption

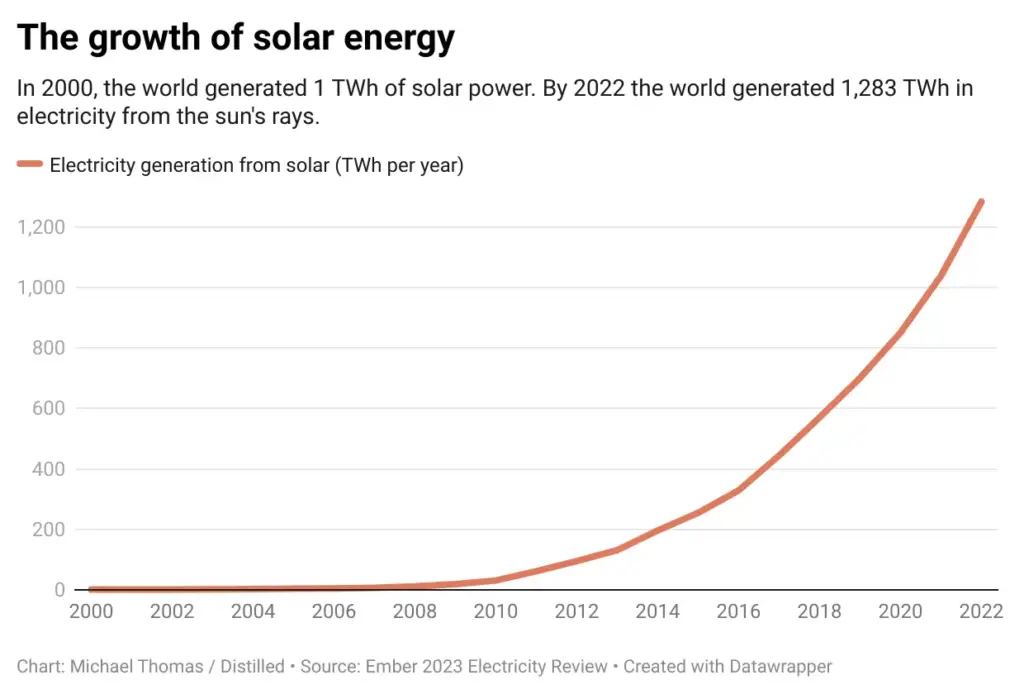

India aims for 500 GW of renewable energy capacity by 2030, according to the International Energy Agency (IEA) and MNRE statements. The PM Surya Ghar scheme aims to install rooftop solar in 10 million homes.

Government subsidies reduce capital cost by up to 40% for smaller residential systems. These policy mechanisms significantly shorten payback periods, making the 4-year claim realistic in many urban centres.

Degradation and Long-Term Performance

Solar panels degrade slowly.

Most manufacturers guarantee:

- Less than 0.5% performance loss per year.

- At least 80% output after 25 years.

Over 25 years, cumulative savings can reach ₹8–₹12 lakh for a mid-sized system, depending on tariff growth. Even after year 25, panels often continue functioning, though at reduced efficiency.

Financing: EMI vs SIP Comparison

Some households finance solar installations through loans.

If:

- Loan EMI: ₹3,000 per month

- Monthly electricity savings: ₹3,500

The system can become cash-flow positive from year one. In contrast, a ₹3,000 monthly SIP in mutual funds builds wealth gradually but remains exposed to market cycles.

The choice becomes one of:

- Immediate bill reduction (solar)

- Long-term capital appreciation (mutual funds)

Many financial advisers recommend diversification rather than substitution.

Risks and Limitations

Balanced reporting requires acknowledging risks.

1. Regulatory Risk

Changes in net metering rules can impact returns.

2. Installation Quality

Poor installation can reduce output.

3. Roof Ownership

Renters cannot benefit directly unless policies evolve.

4. Liquidity

Solar is not easily tradable.

5. Maintenance

Inverters may need replacement after 10–12 years. According to industry data, inverter replacement may cost ₹20,000–₹40,000, which slightly reduces lifetime ROI.

Environmental and Social Value

Financial returns are only one part of the equation. According to the International Renewable Energy Agency (IRENA), rooftop solar reduces carbon emissions significantly over its lifespan.

A 3kW system may offset 3–4 tonnes of CO₂ annually. Over 25 years, that can exceed 70 tonnes. This environmental benefit has no direct equivalent in mutual funds.

DISCOM Perspective and Grid Concerns

Distribution companies (DISCOMs) sometimes express concern over revenue losses from high rooftop solar penetration.

However, energy policy experts note that distributed solar reduces peak demand pressure and transmission losses. The long-term integration challenge lies in grid management, not in rooftop viability.

Residual Value and Property Premium

Several property market studies suggest that homes with solar installations may command higher resale values. Though Indian data remain limited, international research indicates buyers value reduced utility costs. Thus, rooftop solar can function as a home asset improvement.

Is It Really “Better Than Mutual Funds”?

The answer depends on context.

Solar panels:

- Provide stable, predictable savings.

- Hedge against inflation.

- Deliver high effective ROI in high-tariff areas.

- Offer environmental benefits.

Mutual funds:

- Provide liquidity.

- Allow diversification.

- Carry market risk.

- Can outperform solar in bullish markets.

Energy economists argue the framing should not be competitive but complementary. “Solar is an infrastructure hedge. Mutual funds are a market investment. They serve different roles in financial planning,” says a renewable finance specialist based in Mumbai.

Related Links

Solar Trees: High Power in Low Space; Smart ‘Solar Trees’ for Parks and Streets

Start This Profitable Solar Startup Without Heavy Machinery! Demand Surges as Summer Hits

The claim that solar panels pay for themselves in four years and provide 20 years of free electricity is not marketing exaggeration in many Indian states. Supported by falling panel costs, rising electricity tariffs, and government incentives, rooftop solar now delivers strong financial logic alongside environmental benefits.

However, the comparison with mutual funds should be viewed carefully. Solar is best seen as a long-term savings instrument tied to avoided costs rather than market growth.

For many households, it is not a question of replacing mutual funds, but of adding solar as a stable, inflation-protected asset in their financial portfolio.