India’s transition toward cleaner transport fuels has placed new focus on Bio-LNG: Truck Fuel from Stubble; Reliance’s Bio-Gas Plant Changes Waste Economics.

By converting agricultural residue into renewable methane for heavy vehicles, companies such as Reliance Industries Limited (RIL) are attempting to turn crop waste into commercial energy, while addressing air pollution, rural income volatility and fossil fuel dependence.

What Is Bio-LNG and Why It Matters for Transport

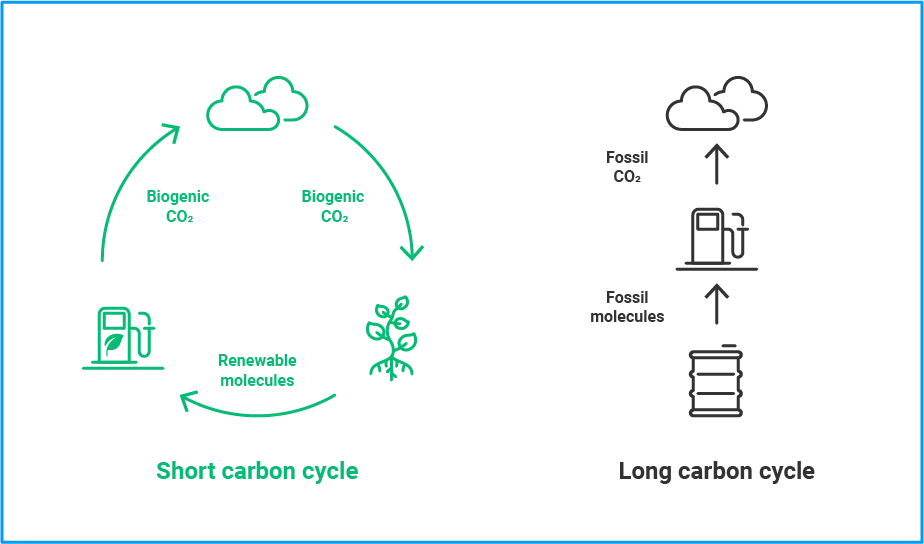

Bio-LNG is liquefied biomethane produced from organic waste through anaerobic digestion and gas upgrading. In simple terms, microorganisms break down crop residue, manure or municipal waste in oxygen-free digesters, producing biogas.

That gas is purified to remove impurities such as carbon dioxide and hydrogen sulphide, yielding high-methane biomethane. The methane is then cooled to minus 162 degrees Celsius, turning it into liquid Bio-LNG.

Chemically, Bio-LNG is nearly identical to fossil LNG. This allows it to be used in existing LNG-powered trucks with minimal modification.

According to the International Energy Agency (IEA), renewable methane can reduce lifecycle greenhouse gas emissions substantially compared with diesel, particularly when derived from waste streams that would otherwise release methane into the atmosphere.

For long-haul trucking, Bio-LNG offers higher energy density than compressed biogas (CBG), making it more practical for vehicles that require long driving range.

The Stubble Challenge and Its Economic Shift

Each year, India produces hundreds of millions of tonnes of agricultural residue, especially rice straw in Punjab and Haryana. A significant portion has historically been burned to clear fields quickly for the next sowing season. This practice contributes to winter smog episodes affecting Delhi and surrounding regions.

Policy discussions increasingly frame stubble not as waste but as feedstock. By creating a commercial market for biomass, bio-gas plants can purchase residue directly from farmers. This shifts the financial equation from disposal cost to revenue opportunity.

Agricultural economists say predictable procurement contracts are essential to encourage farmers to collect and sell residue rather than burn it.

Reliance’s Bio-Gas Expansion and Scale Ambition

Reliance Industries Limited (RIL) has incorporated renewable gas into its broader clean energy portfolio. Through Reliance Bioenergy Limited, the company has commissioned commercial-scale compressed biogas plants and announced plans to establish approximately 100 CBG facilities across India over the coming years.

Public statements from the company indicate these plants could collectively consume millions of tonnes of biomass annually and reduce carbon emissions by around 2 million tonnes per year. RIL has also highlighted the co-production of organic fertiliser as a key by-product, which can be returned to farmers as soil nutrient input.

Industry experts note that while Reliance’s plants are described primarily as CBG facilities, upgraded biomethane can be liquefied into Bio-LNG depending on demand and infrastructure.

How Waste Economics Are Changing

Farmer Payments and Feedstock Pricing

Biomass procurement typically involves aggregators who collect stubble using balers and transport it to processing facilities. Farmers may receive payment per tonne of residue supplied. Pricing varies by region and depends on logistics costs.

If demand is consistent, residue can become a secondary farm income stream, particularly in regions with large crop volumes.

Logistics and Aggregation Challenges

However, biomass collection is complex. Stubble is bulky and seasonal. Storage must prevent moisture damage. Transportation costs can erode margins if plants are far from farms. Energy analysts emphasise that feedstock radius is a major determinant of plant viability.

Carbon Accounting and Climate Impact

Bio-LNG’s environmental benefit depends on lifecycle analysis. When stubble is burned openly, it releases carbon dioxide, methane and particulate matter. Converting it into biomethane captures energy value and avoids some emissions.

However, methane leakage during production or distribution can reduce climate gains. Researchers at energy policy institutes note that strict monitoring and leak detection are necessary to maintain low lifecycle emissions.

Lifecycle assessments typically show significant reductions compared with diesel, though exact percentages depend on operational efficiency.

Comparing Bio-LNG with Electric Trucking

India is also promoting battery electric vehicles (EVs) for freight transport. Electric trucks offer zero tailpipe emissions and lower maintenance costs in urban applications. However, long-haul freight presents challenges due to battery weight, charging time and infrastructure requirements.

Bio-LNG may serve as a transitional solution for heavy-duty, long-distance routes where rapid electrification is difficult. Transport economists suggest a multi-fuel strategy is likely in the coming decades.

Policy Framework and Incentives

India’s Sustainable Alternative Towards Affordable Transportation (SATAT) initiative encourages development of compressed biogas plants and integration into fuel supply chains. Oil marketing companies have entered into offtake agreements for CBG procurement.

Some states provide capital subsidies or viability gap funding to bio-gas projects. Blending mandates for renewable gas in city distribution networks could further stabilise demand. Energy policy specialists say long-term policy consistency will determine investor confidence in the sector.

Infrastructure and Investment Risks

Liquefaction facilities require cryogenic storage and specialised distribution systems. Truck operators must invest in LNG-compatible engines or retrofit existing fleets. Fuel pricing must remain competitive with diesel and fossil LNG to ensure sustained adoption.

Interest rate fluctuations and capital cost overruns could affect project economics. Investors also monitor regulatory clarity and grid gas pricing structures.

Rural Employment and Industrial Spillovers

Bio-gas projects generate employment in construction, operations, maintenance and logistics. Feedstock supply chains create additional jobs in baling, aggregation and transport.

Economists suggest that decentralised renewable gas plants could support rural industrial clusters, provided supply chains are stable. However, benefits depend on fair contract structures and timely payments.

International Benchmarks

Europe has advanced biomethane markets supported by strong climate policy. Germany and France integrate biomethane into gas grids and transport systems.

India’s scale advantage lies in abundant agricultural residue and a large domestic trucking sector. According to international energy outlooks, renewable methane demand is projected to grow steadily in economies pursuing net-zero goals.

Investor and Market Outlook

Energy analysts expect gradual growth rather than rapid transformation. Bio-LNG projects require long-term capital and steady feedstock availability. Market expansion depends on coordinated policy between agriculture, energy and transport ministries.

Corporate participation from companies such as Reliance signals confidence, but sustained growth will require diversified investment beyond a few large players.

Related Links

Bio-LNG derived from crop stubble represents a significant opportunity at the intersection of agriculture, climate policy and transport economics.

By turning residue into renewable fuel, India can reduce stubble burning, lower diesel consumption and create rural income streams.

Reliance’s bio-gas expansion demonstrates corporate commitment to scaling renewable methane infrastructure. Yet long-term success depends on robust supply chains, competitive pricing, environmental safeguards and policy stability.

As India pursues its 2070 net-zero target, Bio-LNG may play an important, though transitional, role in decarbonising heavy transport while reshaping the economics of agricultural waste.