As winter energy bills climb, Canada’s federal Canada Greener Homes Loan program is drawing renewed attention for offering up to $40,000 in interest-free financing for solar panels and other energy-efficient retrofits.

The program, administered by Natural Resources Canada (NRCan), aims to reduce household emissions and long-term energy costs, but strict eligibility rules and funding limits apply.

What Is the Canada Greener Homes Loan?

The Canada Greener Homes Loan is part of the broader Canada Greener Homes Initiative launched in 2021. The federal government introduced the initiative to help homeowners reduce greenhouse gas emissions and improve energy efficiency.

Under the program, eligible homeowners can borrow between $5,000 and $40,000 at zero interest. The repayment period is up to 10 years. According to NRCan, the residential sector accounts for roughly 13% of Canada’s direct greenhouse gas emissions when heating fuels are included.

Federal officials say improving home efficiency is central to meeting Canada’s commitment to cut emissions 40–45% below 2005 levels by 2030. “The loan helps Canadians make energy-saving upgrades more affordable,” NRCan states in its official program guidance.

How the Program Works

The application process follows a structured sequence. Homeowners cannot begin renovations before approval.

Pre-Retrofit Energy Assessment

Applicants must first complete a home energy evaluation through a licensed EnerGuide advisor. This establishes the property’s baseline performance and identifies eligible upgrades.

Application Submission

Homeowners apply through the federal online portal, submitting contractor quotes and retrofit plans. The proposed upgrades must align with recommendations from the energy assessment.

Installation and Verification

After approval, homeowners complete the upgrades. A post-retrofit evaluation confirms the improvements. Loan funds are then released. Failure to follow this sequence can result in disqualification.

Why Solar Is Central to the Program

Solar photovoltaic systems are among the most requested upgrades. Rising electricity rates and climate concerns have increased interest in distributed renewable energy.

The Canada Energy Regulator reports steady growth in residential solar capacity in provinces such as Alberta, Ontario, and British Columbia. Industry data from the Canadian Renewable Energy Association (CanREA) show continued expansion in rooftop installations over the past five years.

Energy analysts note that solar systems reduce reliance on grid electricity and can stabilize long-term household energy costs. However, savings depend on regional electricity rates, net metering policies, and system size.

“Upfront cost remains a major barrier for many households,” said a spokesperson for CanREA during an industry update. “Interest-free financing lowers that barrier significantly.”

Program Deadlines and Funding Limits

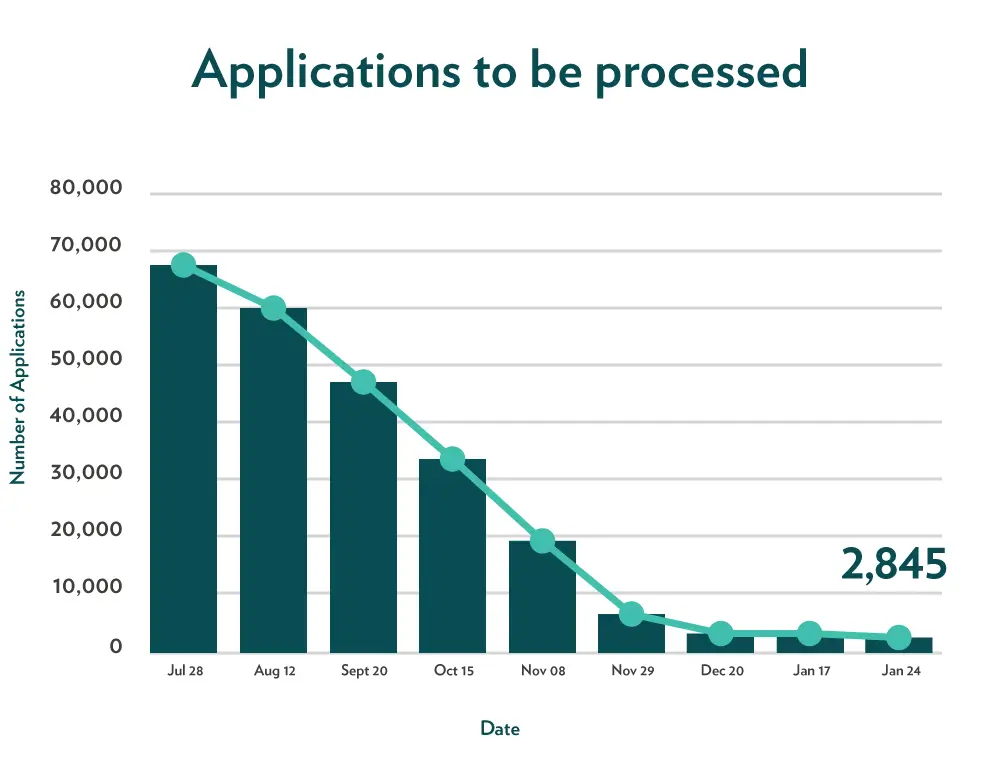

The federal government has stated that funding is subject to availability. Applications are processed on a first-come, first-served basis.

While there is no permanent expiration date written into legislation, NRCan has previously paused related grant programs when funding allocations were exhausted. Officials advise homeowners to check the federal portal regularly for updates.

Applicants should also note that processing times can vary depending on demand.

Economic Rationale Behind Interest-Free Loans

Public finance experts describe the program as a targeted policy tool. Unlike direct grants, interest-free loans preserve federal capital while encouraging private investment in energy infrastructure.

“Zero-interest financing spreads costs over time without increasing household debt burdens through interest payments,” said an economist specializing in climate policy at a Canadian university.

However, critics argue that access may remain limited for lower-income households who struggle with upfront contractor deposits or credit requirements. Housing advocates have called for more targeted assistance to vulnerable communities, particularly in northern regions where heating costs are higher.

Provincial and Utility Incentives

Several provinces offer complementary programs. For example:

- British Columbia provides energy efficiency rebates through BC Hydro.

- Quebec offers financial assistance through Hydro-Québec’s energy efficiency programs.

- Alberta has historically supported residential solar through provincial rebates.

Stacking federal loans with provincial rebates can significantly lower overall project costs. However, eligibility criteria vary. Homeowners are advised to confirm compatibility before applying.

Broader Climate Policy Context

Canada’s emissions reduction plan emphasizes building decarbonization. According to Environment and Climate Change Canada, improving building efficiency reduces strain on the energy grid and lowers fossil fuel consumption.

The federal government has also introduced carbon pricing policies designed to encourage cleaner energy adoption. Analysts say the Greener Homes Loan complements those measures by providing practical financing tools.

Risks and Considerations for Homeowners

Experts caution that solar investments require careful planning. Roof condition, shading, and local weather patterns affect system performance. Inverters may require replacement within 10 to 15 years, even though panels often last 25 years or more.

Financial planners recommend calculating projected energy savings against repayment schedules. In some cases, monthly energy savings may exceed loan payments. In others, savings may take longer to materialize.

Homeowners should also verify contractor credentials and warranty coverage.

Program Transparency and Oversight

NRCan publishes aggregate participation data and program updates online. Federal budget documents outline allocated funding and projected uptake.

The Office of the Auditor General has emphasized the importance of accountability in climate-related spending. Federal officials maintain that reporting mechanisms are in place to ensure transparency.

Impact on the Solar Industry

Industry representatives say the loan program has provided stability for installers and suppliers. Interest-free financing reduces market uncertainty and supports workforce growth in clean energy trades.

At the same time, supply chain constraints and labor shortages have affected installation timelines in some regions. Solar companies advise customers to plan several months in advance, especially during peak seasons.

Related Links

As winter heating demand increases, federal officials expect continued interest in solar and home efficiency upgrades. The long-term viability of the Canada Greener Homes Loan will depend on federal budget decisions and evolving climate targets.

For homeowners weighing energy investments, the availability of up to $40,000 in interest-free financing may shape decisions in the months ahead.

FAQs

Who qualifies?

Applicants must own and reside in the home being upgraded. The home must be at least six months old. New constructions are generally excluded.

Is the loan truly interest-free?

Yes. Borrowers repay only the principal amount over a maximum of 10 years.

Can landlords apply?

Rental properties may be eligible under specific conditions, but the applicant must meet ownership and occupancy requirements outlined by NRCan.

What happens if funding runs out?

Applications may close if allocated funds are fully committed.