The sun offers a clean and abundant source of energy and converting it to power your home with solar panels is a wise investment. But the initial cost can be a hurdle. Thankfully, the U.S. government offers a significant incentive – the Federal Solar Investment Tax Credit (ITC) – to help homeowners make the switch to solar energy. This guide will walk you through everything you need to know to take advantage of this significant financial benefit.

What is the Federal Solar Tax Credit?

The federal solar tax credit allows homeowners to deduct a portion of the cost of installing a solar energy system from their federal taxes. As of 2024, this credit covers 30% of the installation costs for systems installed between 2022 and 2032. The credit percentage will decrease to 26% for systems installed in 2033 and to 22% for those installed in 2034. Unless Congress renews it, the credit will expire in 2035.

Benefits of Claiming the ITC:

- Significant Cost Savings: The ITC can significantly reduce the upfront cost of your solar panel system, making solar power more affordable.

- Faster Payback Period: With lower upfront costs, your solar system will reach its payback period (the time it takes for the energy savings to offset the initial investment) quicker.

- Increased Home Value: Studies show that homes with solar panels can sell faster and for a higher price.

Claiming the ITC:

- Gather Documentation:

- Keep all receipts, invoices, and a certification of system capacity from your solar installer.

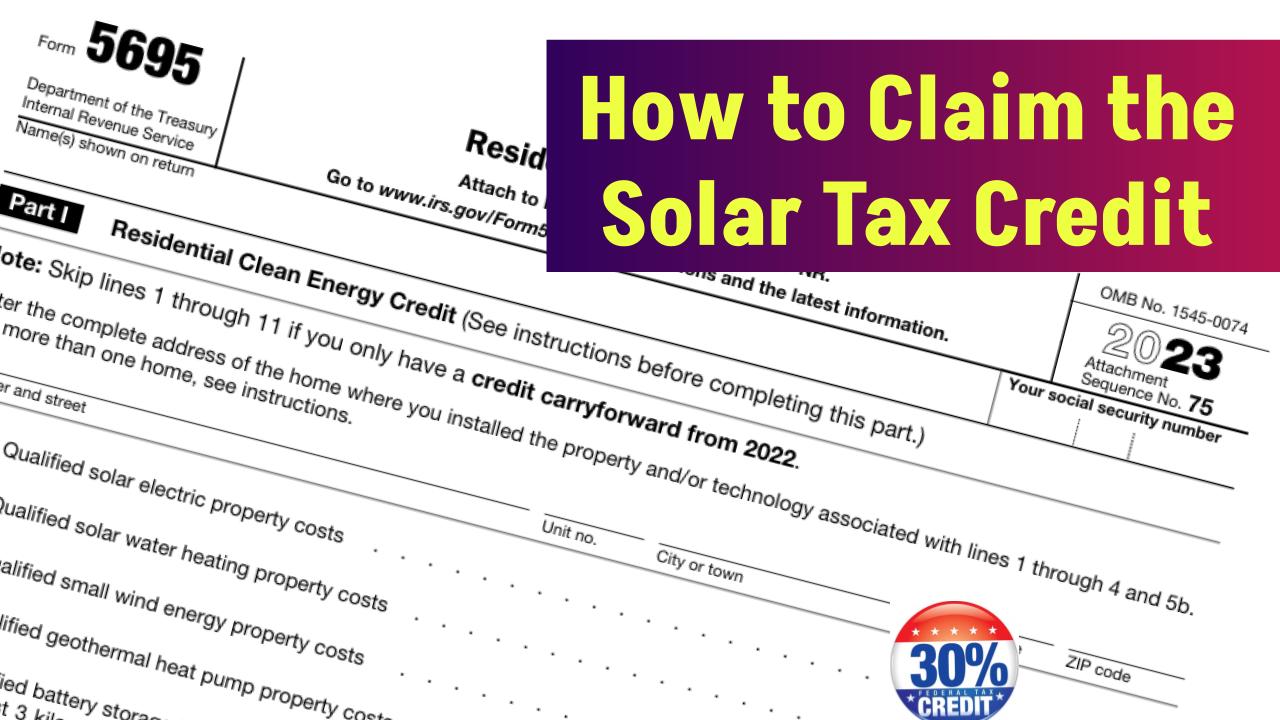

- File Form 5695:

- Include Form 5695, Residential Energy Credits, with your federal tax return for the year your solar system is installed.

- The IRS will calculate the credit amount based on your system cost and apply it to your tax liability.

Eligibility Criteria

To be eligible for the federal solar tax credit, you must meet the following requirements:

- Installation Date: The solar PV system must be installed and operational between January 1, 2017, and December 31, 2034.

- Location: The system must be installed at a residence you own in the United States. This can include primary and secondary residences.

- Ownership: You must own the solar PV system. If you lease the system or purchase electricity generated by a system you do not own, you are not eligible.

- New Systems: The solar PV system must be new or being used for the first time. The credit is only available for the original installation of the system.

What Costs Are Covered?

The federal solar tax credit covers a wide range of expenses related to your solar PV system, including:

- Solar PV Panels or Cells: This includes those used to power an attic fan (but not the fan itself).

- Labor Costs: Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees.

- Balance-of-System Equipment: This includes wiring, inverters, and mounting equipment.

- Energy Storage Devices: Systems with a capacity rating of 3 kilowatt-hours (kWh) or greater installed after December 31, 2022. Energy storage devices installed in subsequent tax years to the solar energy system are also eligible.

- Sales Taxes: Sales taxes on eligible expenses.

How to Claim the Federal Solar Tax Credit

Claiming the solar tax credit is a straightforward process if you follow these steps:

- Install Your Solar Energy System

- Ensure that your solar PV system is fully installed and operational by the end of the tax year for which you want to claim the credit.

- Collect Necessary Documentation

- Gather all receipts, invoices, and any other documentation related to the installation of your solar PV system. This should include costs for equipment, labor, permits, and any other eligible expenses.

- Complete IRS Form 5695

- Fill out Part I of IRS Form 5695, “Residential Energy Credits.”

- Enter the total cost of your solar energy system on line 1.

- Multiply the total cost by 30% (or the applicable percentage for future years) and enter the result on line 6. This is your tax credit amount.

- Include Form 5695 with Your Tax Return

- Attach Form 5695 to your federal tax return (Form 1040).

- Enter the tax credit amount on line 5 of Schedule 3 (Form 1040), then transfer this amount to line 20 of Form 1040.

- Carry Over Unused Credit

- If your tax liability is less than your solar tax credit, you can carry over the remaining credit to the next tax year.

Impact of Other Incentives on the Federal Solar Tax Credit

Several other incentives can impact the amount of the federal solar tax credit you can claim:

- Utility Rebates: Utility rebates typically reduce the cost of your solar PV system before calculating your tax credit. For example, if your system costs $18,000 and you receive a $1,000 rebate, your tax credit is based on $17,000.

- State Rebates: Unlike utility rebates, state rebates usually do not reduce your federal tax credit.

- State Tax Credits: Receiving a state tax credit can increase your federal taxable income, but it does not reduce the federal solar tax credit amount.

- Renewable Energy Certificates: Payments for renewable energy certificates or other incentives may be considered taxable income but do not reduce the federal tax credit.

Special Situations and FAQs

Here are some common questions and special situations regarding the federal solar tax credit:

- Non-Homeowners: Tenants in cooperative housing or condominiums can claim the credit if they contribute to the cost of the solar PV system. Renters cannot claim the credit if the landlord owns the system.

- Vacation Homes: The credit can be claimed for solar PV systems installed on secondary residences but not on rental properties.

- Off-Grid Systems: Systems not connected to the electric grid are eligible as long as they generate electricity for use at your residence.

- Community Solar: Eligibility for community solar programs depends on specific arrangements. Consult IRS guidelines for detailed information.

Conclusion

The federal solar tax credit is a valuable incentive for homeowners looking to invest in solar energy. By understanding the eligibility requirements, covered costs, and how to claim the credit, you can maximize your financial benefits while contributing to a sustainable future.

For more detailed information, visit the U.S. Department of Energy’s Solar Energy Technologies Office and the IRS website.