Switching to solar energy is a smart move for your wallet and the planet. But did you know you can save even more money with the federal solar tax credit? This article will guide you through the process of claiming this valuable incentive.

The sun offers a powerful and eco-friendly way to generate electricity for your home, and the U.S. government incentivizes this switch to solar power with the Solar Investment Tax Credit (ITC). This credit allows you to deduct a significant portion of the cost of installing a solar energy system from your federal income taxes.

Here’s a breakdown of how to claim the solar tax credit and maximize your savings:

What is the Solar Tax Credit?

The solar tax credit, officially known as the Investment Tax Credit (ITC), allows you to deduct a portion of the cost of installing a solar energy system from your federal taxes. For 2024, this credit covers 30% of your solar installation costs, but it’s set to decrease in the coming years.

Eligibility:

- The ITC applies to solar photovoltaic (PV) systems installed on your primary or secondary residence located in the United States.

- There is no minimum or maximum system size requirement.

- The system must be new and placed in service after December 31, 2016.

Credit Percentage:

- Currently, the ITC stands at a generous 30% of the total system cost (including installation) for systems installed between 2022 and 2032.

- This percentage is scheduled to decrease in the coming years, so act now to take full advantage of this benefit.

Claiming the Credit:

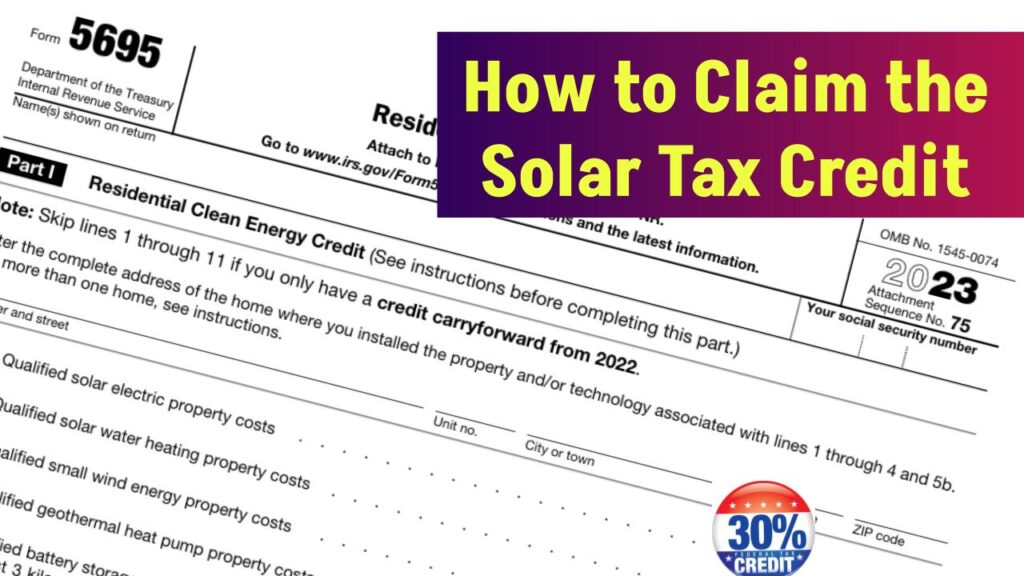

- File Form 5695, Residential Energy Credits with your federal tax return for the year your solar system is installed.

- You’ll need to gather documentation like receipts, invoices, and a certification of system capacity from your solar installer.

- The IRS will then calculate the credit amount based on your system cost and apply it to your tax liability.

Important Tips:

- Don’t overspend to maximize the credit. The credit is based on the total system cost, so focus on getting a good value for your investment.

- The credit can be carried forward. If the credit amount exceeds your tax liability for the year, you can carry it forward to future tax years.

- Consult a tax professional. Tax laws can be complex, and a tax professional can ensure you claim the credit accurately and maximize your benefits.

Steps to Claim the Solar Tax Credit

- Install a Solar Energy System

- Ensure your solar system is installed and operational. Only systems installed by December 31 of the tax year you’re filing for are eligible.

- Gather Your Documents

- Collect all receipts and invoices related to your solar installation. This includes costs for solar panels, inverters, mounting equipment, labor, permits, and any associated sales taxes.

- Fill Out IRS Form 5695

- This form is titled “Residential Energy Credits.” You’ll use Part I to calculate your credit.

- Enter the total cost of your solar energy system on line 1.

- Multiply this amount by 30% (0.30) and enter the result on line 6. This is your tax credit.

- Include the Form with Your Tax Return

- Attach Form 5695 to your federal tax return (Form 1040). If you’re using tax software, it should guide you through this process.

- Enter the tax credit amount on line 5 of Schedule 3 (Form 1040), then transfer this amount to line 20 of Form 1040.

- Claim Any Remaining Credit Next Year

- If your tax liability is less than your solar tax credit, you can carry over the remaining credit to the next tax year.

Benefits of the Solar Tax Credit

- Financial Savings: A 30% deduction on your solar system costs can translate to thousands of dollars in savings.

- Environmental Impact: By switching to solar energy, you’re contributing to the reduction of greenhouse gas emissions and reliance on fossil fuels.

Conclusion

Claiming the solar tax credit is a straightforward process that can result in significant savings. By following these steps, you can maximize your financial benefits while contributing to a greener future. For more detailed information, you can visit the U.S. Department of Energy and the IRS website.