In 2026, the IRS made significant changes to the federal solar tax credit rules, which are now impacting homeowners who are looking to install solar energy systems on their properties. The Investment Tax Credit (ITC), a major incentive designed to reduce the upfront cost of solar panel installation, has undergone important modifications.

For many homeowners, the question remains: How much can they still save now that the rules have changed? Let’s explore how these updates affect both new and existing solar installations in 2026.

What Is the IRS Solar Tax Credit and Why Is It Important?

The IRS Residential Solar Tax Credit (commonly known as the Investment Tax Credit, or ITC) is one of the most significant incentives available for U.S. homeowners who install solar energy systems.

This tax credit allows homeowners to deduct a percentage of the installation cost of a solar energy system from their federal taxes. It has played a key role in expanding solar adoption across the U.S. by lowering the initial costs associated with purchasing and installing solar panels.

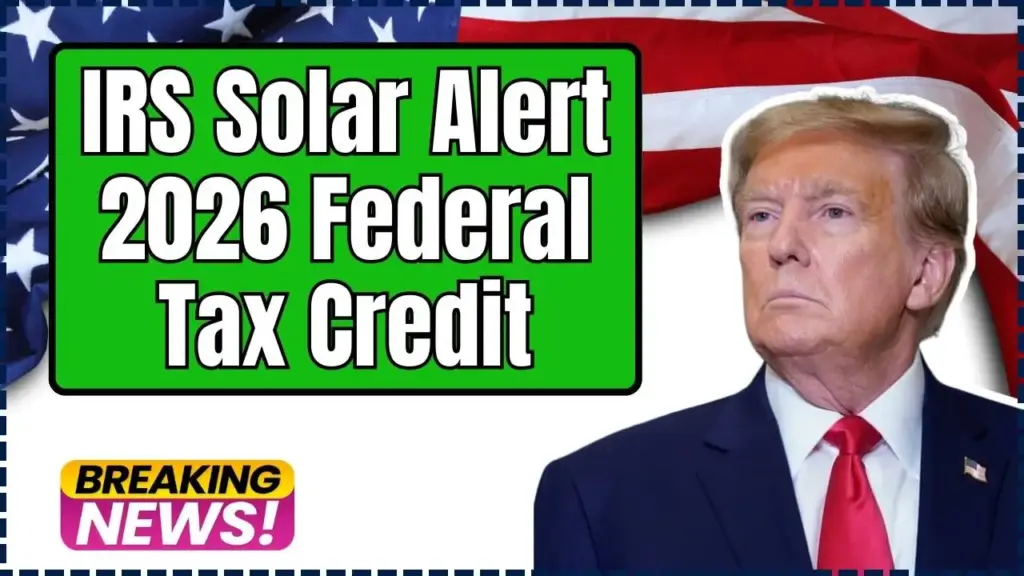

Since its introduction in 2006, the credit has undergone several changes, with fluctuations in the percentage amount allowed to be deducted and the types of solar technologies covered. The ITC was set at 30% under the Inflation Reduction Act (IRA) of 2022 until December 31, 2025. This has made solar systems more affordable for U.S. homeowners, driving a surge in residential solar installations.

Key Changes in 2026: What Homeowners Need to Know

The 2026 federal solar tax credit changes mark the end of the 30% tax credit for residential solar installations that has been in effect since the IRA’s passage in 2022. Starting in 2026, the federal tax credit has been reduced, and this change will affect new solar installations going forward.

Here’s What Changed:

- For systems installed before December 31, 2025: Homeowners can still claim the 30% tax credit if they have installed their solar system and it’s in service by December 31, 2025.

- For systems installed after December 31, 2025: The 30% tax credit expires, and homeowners will see a reduced percentage. Specifically, the credit drops to 26% in 2026.

- Further reductions in future years: The tax credit will further decrease to 22% in 2027 and will likely be phased out entirely by 2028, unless new legislation is passed to extend or restore it.

Thus, the window for claiming the full 30% tax credit is rapidly closing. Homeowners who install their solar systems by the end of 2025 can still claim the 30% tax credit, but after January 1, 2026, they will be subject to a lower rate.

How Much Can Homeowners Save Now?

To understand how much homeowners can save in 2026 under the new IRS rules, here’s an example of how the updated tax credit applies to various solar system costs.

| Solar System Cost | 2026 ITC (26%) | Total Savings |

|---|---|---|

| $20,000 | $5,200 | $5,200 in federal tax savings |

| $25,000 | $6,500 | $6,500 in federal tax savings |

| $30,000 | $7,800 | $7,800 in federal tax savings |

As you can see, the 26% ITC still provides significant savings, but it’s a notable reduction from the 30% tax credit that was available prior to 2026. Homeowners who waited until the beginning of 2026 or later to install solar systems will see a drop in their potential savings.

This change has created a sense of urgency among homeowners interested in solar, with many now looking to install systems before the end of 2025 to take full advantage of the 30% tax credit.

Why the 2026 Changes Matter for Homeowners

The federal tax credit reduction comes at a time when solar energy adoption in the U.S. is reaching new heights. Many experts and industry leaders have expressed concern about the potential impact of the ITC reduction on the solar market in 2026 and beyond. Here’s why this change matters:

1. Solar Panel Costs Are Still High

While the cost of solar panels has dropped significantly in recent years, it still represents a major upfront investment for most homeowners. The 30% tax credit had made this investment more affordable for many families, especially in regions with higher electricity costs.

With the credit dropping to 26% in 2026, homeowners will see slightly less financial relief from the tax incentive.

2. Reduced Savings Lead to Lower Payback Periods

The reduced ITC means that homeowners will face longer payback periods for their solar system investments. For example, in regions with high electricity prices, it may take longer for homeowners to recoup their solar installation costs without the full 30% credit.

Solar energy systems are typically designed to pay for themselves within 7 to 10 years, depending on the location and system size, but the reduction in the federal tax credit will extend this timeline slightly.

3. Local and State Programs Remain Critical

In response to the federal credit changes, many states and local governments are working to expand solar incentives at the state level. Programs like California’s Solar Initiative or New York’s NY-Sun Program still offer subsidies or rebates for solar installations.

Homeowners are advised to check state‑specific programs that could help offset the federal ITC reduction and maintain their savings.

Maximize Savings Before the 2026 Change

Given the reduced ITC rate in 2026, many homeowners are exploring options to take advantage of the current 30% credit. Here are some strategies for maximizing savings:

1. Install Solar Before 2025

The most straightforward strategy for homeowners is to install solar panels before December 31, 2025, in order to secure the 30% federal tax credit. This may require quick action and careful planning, as the process of selecting a solar installer, completing system design, and finalizing grid connection approval can take several months.

2. Leverage Additional Local Incentives

As mentioned, state-level programs still exist in many parts of the country, offering additional rebates or incentives. Combine these with the federal tax credit to boost overall savings. For example, California provides additional rebates for residential solar, while New York offers performance-based incentives.

3. Plan for Net Metering Benefits

Net metering can also help reduce electricity bills by selling excess energy back to the grid. Be sure to inquire whether your utility provider has net metering programs that work well with solar installations. This can add to your overall financial savings by offsetting grid energy consumption.

What’s Next for Solar in the U.S. After 2026?

The future of solar energy in the U.S. looks promising despite the changes to the ITC. Some key factors shaping the solar energy market post-2026 include:

- Solar Technology Advancements: The cost of solar technology is expected to decrease further as new materials, manufacturing processes, and battery storage solutions become mainstream.

- Increased State Incentives: Local programs and clean energy policies will continue to support residential solar systems.

- Federal Clean Energy Initiatives: Future federal policies may reintroduce or extend certain solar incentives or tax breaks.

Homeowners interested in solar energy should stay informed about new policy updates and local programs that may affect their investment decisions.

Related Links

The IRS federal tax credit changes for 2026 are a pivotal moment in the U.S. solar energy landscape. While the 30% Residential Solar Tax Credit is being phased out, there is still an opportunity for homeowners to save significant amounts on their solar installations, especially for systems installed before December 31, 2025.

By planning ahead and leveraging state-level incentives, homeowners can still achieve considerable savings and contribute to a greener future.

For many, solar energy remains a sound investment, even as federal incentives evolve. Homeowners should act quickly to maximize benefits under the current federal tax rules, as solar technology continues to be a key player in the push for clean, renewable energy in the U.S.