India’s solar energy market is riding high, with significant players like Tata Power and Adani Green Energy at the forefront of a major growth wave. The solar sector has posted a 250% surge in installations, with these companies emerging as key beneficiaries of government incentives and the accelerating shift towards renewable energy.

In light of this rapid expansion, 2026 promises even more momentum for India’s solar stocks. But with so many players in the market, the crucial question for investors is: Which solar stock will be the next multibagger?

This article examines Tata Power and Adani Green alongside other noteworthy companies in the Indian solar sector, breaking down the reasons behind their success and what the future holds for these stocks.

India’s Solar Market: Explosive Growth and Policy Support

India’s solar energy industry is expanding at an impressive rate, driven by a mix of government support, private investments, and technological innovations. According to MNRE (Ministry of New and Renewable Energy), India added over 8,000 MW of solar capacity in 2025, marking one of its highest growth years in the renewable sector.

In line with its 500 GW renewable energy target by 2030, India has actively introduced programs like the PM Surya Ghar Scheme, which aims to expand rooftop solar capacity. The government has also provided up to 40% subsidies for residential solar installations, which has spurred a wave of new installations across the country.

With solar becoming increasingly cost-competitive compared to traditional energy sources, the sector is seeing new investments, and solar stocks are benefiting.

Tata Power – A Diversified Player with Solar Momentum

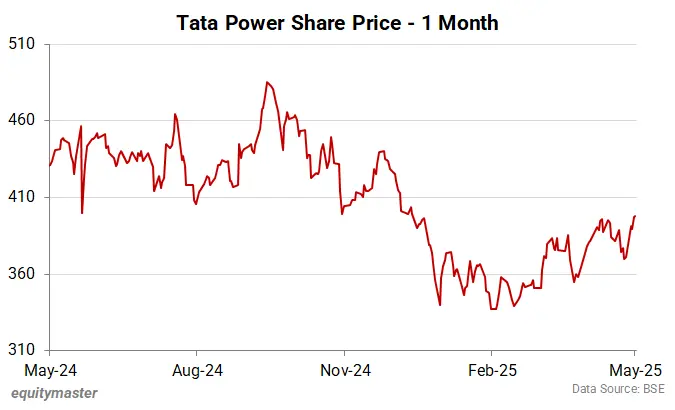

Tata Power, one of India’s oldest and largest integrated power companies, has been pivoting strongly toward solar energy in recent years. With an expanding solar portfolio, the company’s transition from fossil fuels to renewables has bolstered its stock performance.

- Strengths:

- Diversified Portfolio: Tata Power’s business spans from thermal power to hydro and solar energy, providing stability.

- Government Tie-ups: Tata Power has secured numerous government contracts for large solar projects, positioning itself as a significant player.

- Recent Developments:

- Tata Power Solar Systems Ltd. is one of India’s largest solar EPC (engineering, procurement, and construction) companies.

- The company has recently commissioned a 2 GW solar capacity and is targeting 5 GW by 2030.

As of early 2026, Tata Power’s stock is a strong pick for conservative investors due to its diversified business, steady earnings, and established market presence. Tata Power has shown strong returns, and investors see it as a reliable player in India’s renewable energy push.

Adani Green Energy – Aggressive Expansion and High Growth Potential

Adani Green Energy, a subsidiary of the Adani Group, has been a top performer in India’s solar space, benefitting from aggressive expansion and large-scale renewable energy projects. Adani Green has consistently attracted investor attention due to its rapid growth trajectory.

- Strengths:

- Project Pipeline: Adani Green is rapidly scaling its renewable energy capacity, with 13 GW of operational capacity and a target to reach 25 GW by 2030.

- Strong Financial Backing: Being part of the Adani Group provides Adani Green with strong capital resources and institutional support.

- Recent Developments:

- In 2025, Adani Green signed contracts for 3 GW of solar projects, continuing its leadership in India’s utility-scale solar sector.

- The company’s stock has increased by more than 60% since early 2025, positioning it as one of the leading solar stocks.

Adani Green is a growth-oriented stock, with high upside potential for investors willing to accept higher risk for higher rewards.

3. NTPC Ltd – India’s Largest Utility with a Strong Solar Pivot

NTPC Ltd, India’s largest power utility, has been expanding into the renewable energy sector aggressively. While NTPC has traditionally been a thermal energy giant, it has made significant strides in solar and other renewable energy sources.

- Strengths:

- Financial Stability: As a government-backed utility, NTPC offers a level of security that many private companies cannot match.

- Ambitious Renewable Targets: NTPC aims to add 60 GW of renewable capacity by 2032, a significant portion of which will be solar.

- Recent Developments:

- NTPC recently commissioned a 1 GW solar project and has announced plans for another 3 GW capacity over the next two years.

- The company’s stock price remains stable, with a long-term growth trajectory driven by renewable energy investments.

NTPC’s solid revenue base and commitment to increasing renewable capacity make it an attractive blue-chip investment for conservative investors.

4. JSW Energy – A Key Player in Solar Expansion

JSW Energy, part of the JSW Group, has steadily increased its presence in the renewable sector. With a strong focus on solar energy, JSW Energy is expected to grow its clean energy capacity in the coming years.

- Strengths:

- Strong Corporate Backing: As part of the JSW Group, JSW Energy benefits from the financial muscle of a large conglomerate.

- Renewable Growth: The company has 2.5 GW of renewable capacity and plans to grow it to 5 GW by 2025.

- Recent Developments:

- JSW recently secured a 1 GW solar project in Rajasthan and is building green hydrogen capacity.

- Its focus on wind and solar hybrid solutions makes it a promising player in the renewables sector.

JSW Energy is an excellent choice for growth investors looking to tap into the expanding solar sector while diversifying across multiple energy types.

5. Borosil Renewables – Niche Solar Glass Manufacturer with Huge Upside

While not directly involved in power generation, Borosil Renewables is one of India’s largest manufacturers of solar glass, a critical component in solar panel production.

- Strengths:

- Market Leader in Solar Glass: Borosil is a leading supplier of solar glass, an essential part of solar panels.

- Increasing Demand: As India’s solar sector expands, demand for solar glass is expected to grow rapidly.

- Recent Developments:

- In 2025, Borosil expanded its solar glass production by 50% to meet rising demand.

- The company’s shares have surged as solar panel makers look for reliable suppliers of high-quality solar glass.

Borosil is a unique play for investors looking to gain indirect exposure to the booming solar sector by focusing on the solar supply chain.

Why Solar Stocks Are the Future

The solar industry is on the verge of becoming a dominant player in India’s energy mix, driven by:

- Strong Policy Support: Government incentives, subsidies, and ambitious clean energy targets continue to drive solar adoption.

- Technological Advancements: Solar panel prices are falling, and efficiency is increasing, making solar an increasingly viable energy source.

- International Expansion: Leading Indian solar companies are beginning to expand into international markets, providing further growth opportunities.

Related Links

Risks to Consider

Despite the robust growth outlook, there are several risks:

- Policy Changes: Regulatory shifts or cuts in subsidies could impact profit margins and growth rates.

- Financing Availability: While the sector has attracted significant investment, securing financing for large projects can become more challenging.

- Market Competition: As the market expands, competition could increase, driving down margins, especially in equipment manufacturing.

India’s solar sector is witnessing a golden era of growth, with companies like Tata Power and Adani Green leading the way. With strong government backing, falling technology costs, and increasing public awareness, these stocks are poised for long-term growth.

Investors looking to enter the sector should consider Tata Power for its stability and Adani Green for its aggressive expansion strategy, along with other key players like JSW Energy and Borosil Renewables.