Under the Make in India programme, India’s solar manufacturing sector has transformed from a largely import-dependent industry into a rising global supplier. With export volumes rising sharply since 2023 and capacity expanding across modules and cells, international buyers are increasingly sourcing Indian solar panels as part of supply chain diversification strategies.

This shift reflects policy support, geopolitical realignment and growing production scale, positioning India as an emerging player in the global solar export market.

From Import Dependence to Export Ambition

Until 2018, India relied heavily on imported solar modules, particularly from China. According to data from the Ministry of New and Renewable Energy (MNRE), more than 80% of India’s installed solar capacity once depended on foreign modules.

That equation is changing.

Through tariff measures such as the Basic Customs Duty (BCD) and quality controls like the Approved List of Models and Manufacturers (ALMM), the government encouraged domestic production. The introduction of the Production Linked Incentive (PLI) Scheme for High Efficiency Solar PV Modules marked a turning point.

According to official MNRE releases, the PLI programme aims to support over 40 GW of integrated solar manufacturing capacity in phases. This includes modules, cells, wafers and upstream components. The result is structural transformation rather than incremental growth.

Manufacturing Capacity: The Numbers Behind the Surge

Rapid Capacity Expansion

Industry data compiled by research agencies such as JMK Research and Mercom India indicate:

- Solar module manufacturing capacity exceeded 60 GW annually by late 2025.

- Solar cell capacity crossed 15–20 GW, up from less than 5 GW three years earlier.

- Several integrated manufacturing facilities are under construction.

By comparison, India’s domestic annual solar installation demand ranges between 12–15 GW. This creates surplus capacity — a prerequisite for export growth.

Why Global Buyers Are Turning to India

1. Supply Chain Diversification

China controls over 70% of global solar module manufacturing and an even larger share of upstream components such as wafers and polysilicon, according to the International Energy Agency (IEA).

However, trade tensions, anti-dumping duties and geopolitical uncertainties have encouraged what analysts call a “China Plus One” strategy. India has emerged as a credible alternative because it offers:

- Political stability

- Growing industrial base

- Policy continuity

- English-speaking technical workforce

Dr. Rahul Tongia, senior fellow at the Centre for Social and Economic Progress (CSEP), has noted that diversification is not just political but commercial. Buyers seek resilience in supply chains, even at slightly higher cost.

2. Competitive Pricing

Indian module prices have become increasingly competitive. Industry data suggests Indian modules are often 10–20% cheaper than U.S.-manufactured alternatives.

Labour cost advantages, economies of scale and improved efficiency contribute to price competitiveness. However, India still imports much of its polysilicon and wafers, which affects full vertical cost control.

3. Trade Realignment and Tariff Windows

Recent tariff measures in Western markets against Chinese solar imports have indirectly benefited Indian exporters.

The United States remains one of the largest destinations for Indian modules. Industry estimates suggest Indian solar exports crossed several gigawatts annually between 2024 and 2026, with a significant share going to North America.

European demand has also grown as the European Union works to reduce dependence on concentrated suppliers.

Export Geography: Where Indian Panels Are Going

United States

The U.S. solar market is expanding under climate-linked legislation and renewable targets. Indian manufacturers have gained traction due to:

- Lower tariff exposure compared to Chinese suppliers

- Competitive pricing

- Compliance with certification standards

However, export exposure to a single large market carries risk if policy changes occur.

Europe

The European Union’s renewable targets and energy security concerns following geopolitical disruptions have expanded demand for diversified suppliers.Indian manufacturers that meet EU certification and ESG standards are gaining ground.

Africa and Middle East

Emerging economies seeking affordable solar deployment have shown increasing interest in Indian panels. India’s diplomatic and development ties also support solar cooperation through concessional financing and multilateral partnerships.

The Solar Value Chain: Strengths and Gaps

While module assembly capacity is expanding rapidly, upstream integration remains limited.

India has strong presence in:

- Module assembly

- EPC services

- Project development

However, wafer and polysilicon production is still developing. Industry experts caution that without deeper vertical integration, export competitiveness may fluctuate based on global raw material prices.

Financing and Export Ecosystem

Export growth depends not only on manufacturing but also on financing and logistics.

Indian exporters benefit from:

- Export credit lines

- Government-backed credit guarantee schemes

- Public sector bank lending support

However, large-scale export contracts require working capital strength and hedging capabilities, areas where only large manufacturers currently operate comfortably.

Sustainability and ESG Compliance

Global buyers increasingly demand compliance with environmental, social and governance (ESG) standards. European markets are particularly sensitive to:

- Carbon footprint transparency

- Ethical sourcing

- Supply chain traceability

India’s manufacturers are beginning to adapt to these compliance requirements, though standards vary across companies.

The upcoming European Carbon Border Adjustment Mechanism (CBAM) may also influence solar exports in future, depending on lifecycle emission accounting.

Employment and Industrial Impact

The expansion of solar manufacturing has employment implications. Industry bodies estimate that solar manufacturing and associated services could generate tens of thousands of jobs across:

- Industrial corridors

- Port logistics hubs

- Ancillary component manufacturing

States such as Gujarat, Tamil Nadu and Rajasthan are emerging as solar manufacturing clusters.

Risks and Structural Challenges

Overcapacity Risk

If global demand slows or domestic installations fall, India could face excess manufacturing capacity. Overcapacity may lead to price crashes, affecting margins and sustainability of smaller manufacturers.

Dependence on Imported Inputs

Until India develops domestic polysilicon and wafer production at scale, it remains partially exposed to global supply fluctuations.

Trade Barriers

Anti-dumping investigations, tariff adjustments or geopolitical realignment could impact export flows. Balanced trade diplomacy will be essential.

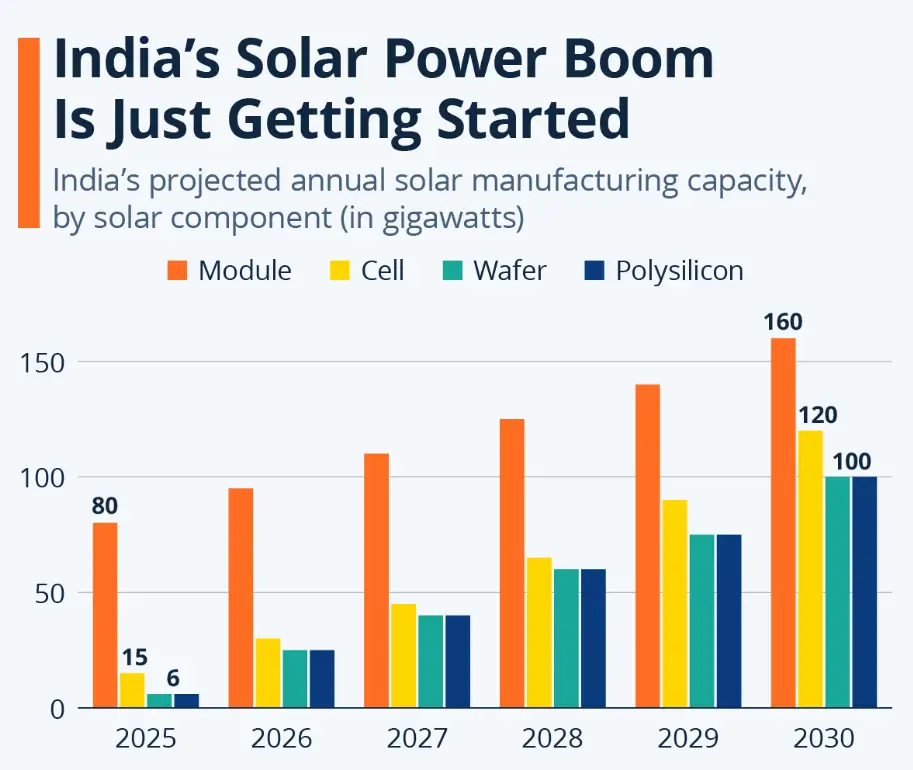

Long-Term Outlook to 2030

Industry analysts project that if current trends continue:

- India could become one of the top three global module exporters by 2030.

- Manufacturing capacity may exceed 120 GW annually.

- Export share could form a significant percentage of production.

However, success depends on:

- Continued policy stability

- Upstream integration

- Technological upgrades

- Global market diversification

Related Links

The rise of Indian solar panel exports under the Make in India framework represents a structural shift in the country’s industrial strategy. What began as a domestic energy security initiative has evolved into a global manufacturing play.

International buyers are queuing up not only because of price advantages, but also because India offers scale, policy stability and supply chain diversification. Yet the path ahead requires careful balancing of export ambition with domestic needs, deeper value chain integration, and resilience against global market volatility.

If managed effectively, India’s solar export push could become one of the defining industrial success stories of the decade.