India’s rapid expansion of solar power has sparked what analysts describe as a Solar Gold Rush, with billions of dollars flowing into new projects across the country. Backed by ambitious government targets and rising electricity demand, the sector promises scale and growth.

Yet experts warn that regulatory uncertainty, supply chain gaps and financial stress in the power system could affect long-term returns.

A Market Expanding at Historic Speed

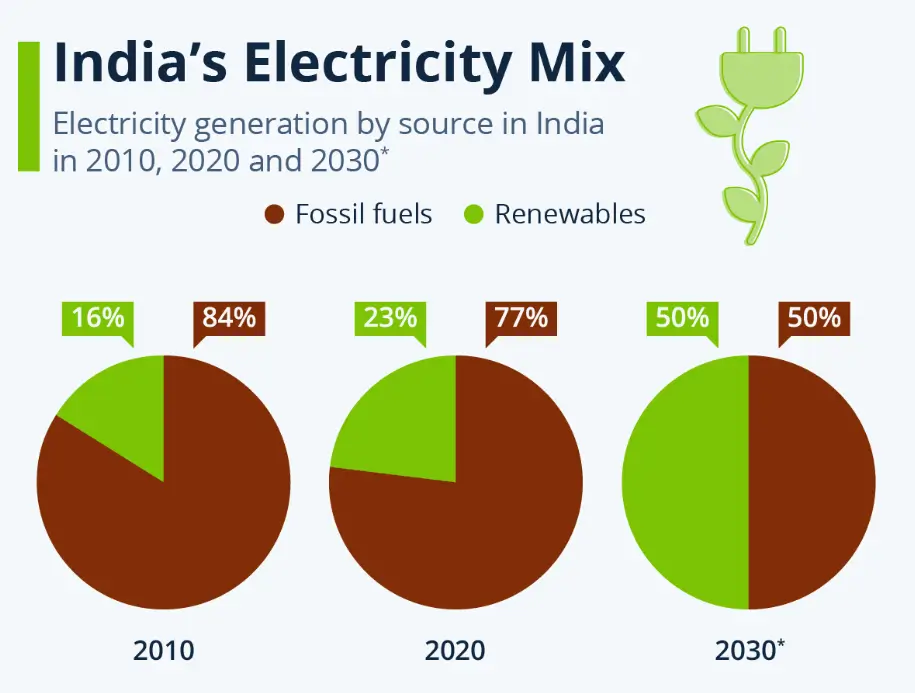

India is now among the world’s fastest-growing renewable energy markets. According to the Ministry of New and Renewable Energy (MNRE), installed solar capacity has increased more than sevenfold since 2016.

The government has committed to achieving 500 gigawatts of non-fossil fuel capacity by 2030. Solar energy is expected to account for a large share of that target. The International Energy Agency (IEA) has described India as a “key driver” of global renewable growth over the next decade.

In its World Energy Outlook, the IEA noted that India’s solar additions are likely to exceed those of many developed economies due to strong policy momentum and expanding demand. Electricity demand itself is rising. The Central Electricity Authority (CEA) reported record peak demand levels in recent summers, driven by industrial growth and prolonged heatwaves.

Why the Solar Gold Rush Is Accelerating

Policy Framework and Auctions

Competitive auctions conducted by the Solar Energy Corporation of India (SECI) have been central to the Solar Gold Rush. These auctions provide developers with long-term power purchase agreements, offering revenue visibility.

Solar tariffs have fallen sharply over the past decade. According to SECI data, auction prices have declined to levels competitive with coal-based power generation in many regions.

Government schemes such as rooftop solar subsidies and production-linked incentives (PLI) for manufacturing have further strengthened the investment case.

In a policy statement, the MNRE said expanding domestic manufacturing would “enhance energy security and reduce import dependence.”

Capital Flows and Financial Engineering

The Solar Gold Rush has attracted domestic conglomerates, international utilities, sovereign wealth funds and pension funds. Infrastructure investment trusts (InvITs) have emerged as vehicles for monetising operational solar assets. These structures allow developers to recycle capital into new projects.

According to the Reserve Bank of India (RBI), lending to renewable energy projects has grown steadily. However, interest rate movements affect project economics. Renewable projects rely heavily on debt financing, making them sensitive to borrowing costs.

“Lower financing costs are critical to maintaining competitive tariffs,” said a renewable energy analyst at CRISIL Ratings, in a sector assessment note.

Manufacturing Push and Supply Chain Risks

Domestic Production Ambitions

India’s PLI scheme aims to build an integrated domestic solar manufacturing ecosystem, including modules, cells and potentially wafers.

The government has approved tens of gigawatts of manufacturing capacity under this programme. Officials argue that this will reduce vulnerability to external shocks.

Continued Import Dependence

Despite these efforts, India remains dependent on imported photovoltaic components, particularly from China. According to trade data cited by the Institute for Energy Economics and Financial Analysis (IEEFA), a large portion of solar cells and wafers are still sourced internationally.

Supply chain concentration exposes developers to currency fluctuations, trade barriers and geopolitical tensions.

“Manufacturing capacity is growing, but upstream integration remains limited,” said Vibhuti Garg, an energy economist at IEEFA.

The DISCOM Challenge

India’s electricity distribution companies (DISCOMs) are financially strained in several states. According to data from the Power Finance Corporation (PFC), overdue payments to generators have periodically exceeded regulatory thresholds.

Delayed payments can disrupt cash flows for solar developers. Although central reforms aim to improve DISCOM performance, structural issues such as tariff gaps and transmission losses persist.

“Financial discipline at the distribution level is essential for sector stability,” said an energy policy researcher at the Centre for Policy Research (CPR).

Land, Environment and Community Impact

Large solar parks require significant land. In states such as Rajasthan and Gujarat, projects often occupy arid or semi-arid areas.

While solar energy reduces carbon emissions, land acquisition can generate local resistance. Community groups have raised concerns about grazing land loss and ecological impact.

Environmental clearances are generally streamlined for renewable projects, but biodiversity considerations are gaining attention. Experts note that project siting must balance climate goals with local livelihoods.

Climate Exposure and Insurance Risks

Solar panels are vulnerable to extreme weather, including cyclones, dust storms and flooding. India has experienced rising climate variability. According to the India Meteorological Department (IMD), extreme weather events have increased in frequency in some regions.

Insurance costs for renewable assets may rise if climate-related damage becomes more frequent. Investors now assess physical climate risk as part of project due diligence.

Grid Stability and Storage Imperatives

As solar penetration rises, grid management becomes more complex. The CEA has emphasised the need for transmission expansion and energy storage systems. Battery storage remains costly, though prices are declining globally.

The International Solar Alliance (ISA) has advocated scaling storage deployment to ensure reliability. “Solar alone cannot provide round-the-clock power without complementary systems,” said Ajay Mathur, Director General of ISA.

Hybrid wind-solar projects are increasingly used to smooth generation patterns.

Corporate Governance and Contract Risks

India’s renewable sector includes large listed conglomerates and emerging developers. Corporate governance standards vary. Credit rating agencies such as Fitch Ratings and Moody’s Investors Service evaluate project leverage, debt structures and related-party transactions.

In past years, certain state governments attempted to renegotiate solar contracts, citing financial distress. The Supreme Court of India has upheld contractual sanctity in key cases, reinforcing investor protections. Nonetheless, regulatory divergence between states remains a watchpoint for foreign investors.

ESG Scrutiny and International Capital

Environmental, Social and Governance (ESG) frameworks influence global investment flows. India’s renewable projects often qualify as green investments. However, ESG-focused investors increasingly examine supply chain transparency, labour standards and environmental impact.

“Investors are moving beyond headline capacity numbers,” said a portfolio manager at a European pension fund active in India’s renewable market. “They are asking about governance, resilience and community engagement.”

Global Context: Competing Markets

India is not alone in expanding solar capacity. The United States, China and the European Union have also increased renewable deployment through subsidy programmes.

India’s advantage lies in scale and demand growth. However, policy certainty and infrastructure readiness determine how it compares internationally.

According to the IEA, emerging markets with stable regulatory frameworks are likely to attract the largest share of renewable capital over the next decade.

What Investors Are Watching Now

Market participants tracking the Solar Gold Rush focus on:

- Stability of auction mechanisms

- Strength of DISCOM reforms

- Progress in domestic manufacturing

- Transmission infrastructure build-out

- Interest rate trends

- Adoption of battery storage

Project viability depends on long-term planning rather than short-term speculation.

Related Links

Perovskite Cells: Silicon’s Successor is Ready! Cheaper and More Efficient Solar Cells.

India’s Solar Gold Rush marks a defining chapter in the country’s energy transition. Solar capacity has expanded rapidly, supported by government ambition and rising power demand.

Yet beneath the momentum lie structural challenges. Supply chain exposure, financial stress in distribution companies, land constraints, climate risks and regulatory complexity all shape the investment landscape.

For policymakers, ensuring stability and transparency remains critical. For investors, the opportunity is significant but requires careful assessment of financial, operational and governance risks.

The transition is underway. Whether it becomes a sustained transformation or a volatile cycle will depend on execution, discipline and policy consistency in the years ahead.