India’s rapid clean energy expansion has created an unexpected market imbalance. A surge in factory investments has led to a solar manufacturing capacity glut, with production capability now exceeding near-term demand.

While lower module prices are helping project developers, manufacturers face shrinking margins, lower utilisation, and growing financial pressure.

The imbalance highlights the risks of scaling industrial capacity faster than domestic deployment. It also raises questions about how India will manage its renewable ambitions while protecting manufacturing stability.

Solar Manufacturing Capacity Glut: How the Gap Emerged

India has set a target of 500 gigawatts (GW) of non-fossil fuel capacity by 2030, with solar power expected to play a leading role. To reduce reliance on imports and strengthen domestic supply chains, the government introduced several policy measures.

These included the Production Linked Incentive (PLI) scheme, customs duties on imported solar modules and cells, and the Approved List of Models and Manufacturers (ALMM). Together, they encouraged companies to expand or establish manufacturing facilities at record speed.

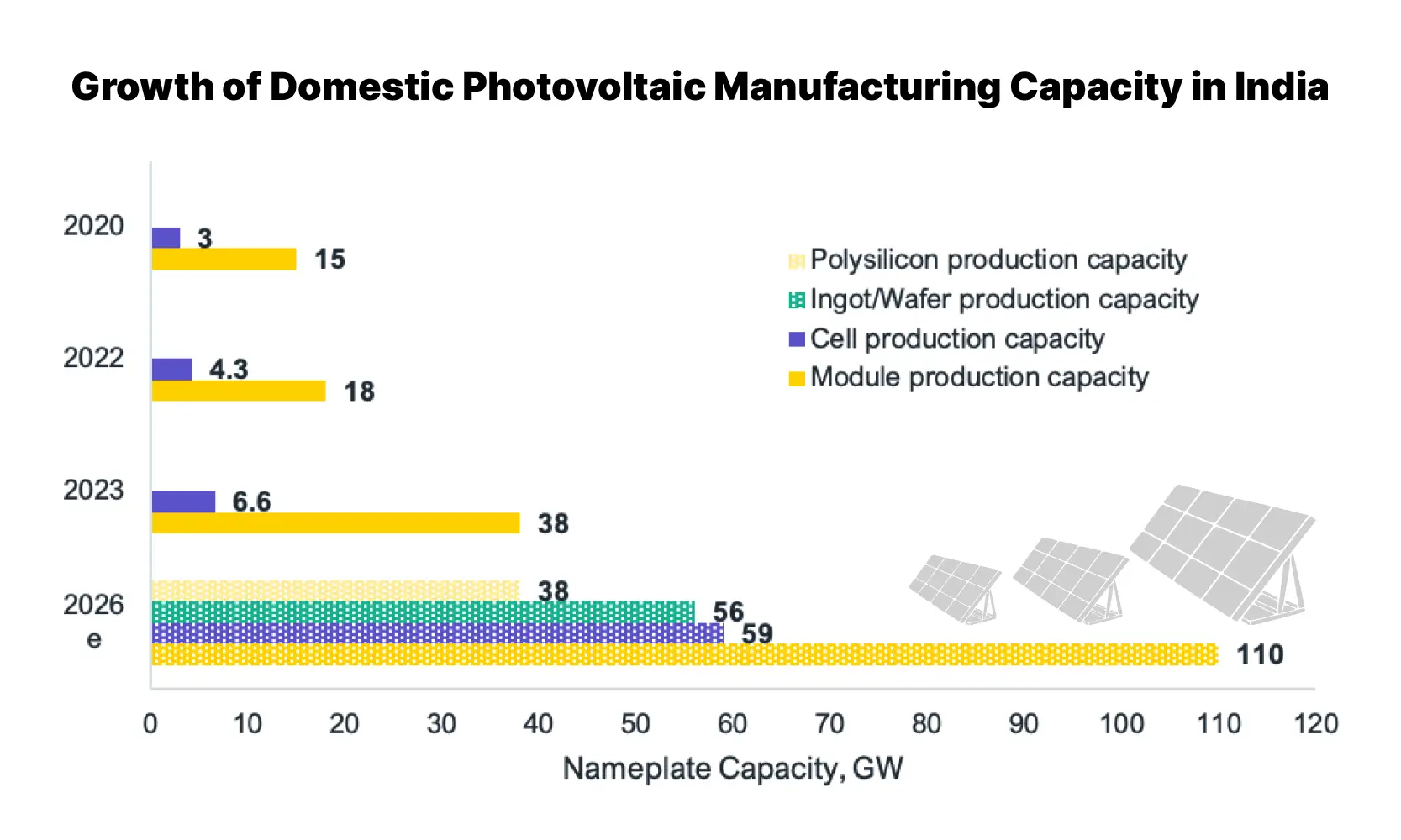

According to data from the Ministry of New and Renewable Energy (MNRE) and industry estimates from Mercom India, module manufacturing capacity has crossed 60 GW annually. In contrast, India installed around 15–18 GW of solar capacity annually in recent years.

This gap between potential output and actual installations defines the solar manufacturing capacity glut.

“Capacity has grown much faster than annual deployment,” said Raj Prabhu, Chief Executive Officer of Mercom Capital Group, in a recent industry discussion. “Unless installations accelerate significantly, utilisation will remain under pressure.”

A Global Context: Not Just an Indian Story

India is not alone in facing oversupply pressures. The International Energy Agency (IEA) has warned that global solar manufacturing capacity has expanded rapidly, especially in Asia, creating intense price competition.

China remains the dominant player in the global solar supply chain. When global module prices decline due to excess supply, Indian manufacturers must match those prices to remain competitive.

However, unlike China, India’s upstream manufacturing—such as polysilicon and wafer production—remains limited. This partial integration means many Indian manufacturers still rely on imported inputs, which can affect cost competitiveness.

Falling Prices: Relief for Developers

Oversupply has placed downward pressure on module prices. Industry executives report that domestic module prices have declined over the past year, reflecting intense competition among manufacturers.

Lower prices reduce overall project costs. For solar developers bidding in government auctions conducted by the Solar Energy Corporation of India (SECI), cheaper modules improve the economics of new projects.

This has contributed to historically low solar tariffs in India. Affordable tariffs benefit electricity distribution companies and consumers, particularly in price-sensitive markets.

“Lower module prices support India’s energy transition goals,” said Vinay Rustagi, Managing Director of Bridge to India. “But the challenge is ensuring that manufacturers remain financially viable.”

Shrinking Margins and Lower Utilisation

For manufacturers, the picture is more complex. Industry sources indicate that factory utilisation rates have declined in recent months. Some facilities are operating at 40–50 percent capacity.

Lower utilisation increases fixed costs per unit and compresses margins. Smaller companies, especially those that expanded rapidly using debt financing, may find it difficult to maintain operations if price pressures persist.

Banks are monitoring the situation closely. Financial institutions typically assess demand visibility before extending credit for capital-intensive industries.

An economist speaking at a public seminar hosted by the Reserve Bank of India noted that “rapid expansion phases often lead to temporary imbalances. Sustainable growth requires demand to keep pace with supply.”

Regional Impact: Manufacturing Hubs Under Strain

The solar manufacturing expansion has been concentrated in states such as Gujarat, Tamil Nadu, and Rajasthan. These regions attracted investment due to supportive state policies, land availability, and port access.

Local economies benefited from job creation and industrial growth. However, if utilisation remains weak, employment growth could slow. Industry associations caution that prolonged stress may affect ancillary suppliers, including glass, aluminium frame, and inverter manufacturers.

State governments are closely watching developments. Officials say they remain committed to supporting renewable manufacturing but acknowledge that global market dynamics influence outcomes.

Export Markets: Opportunity and Uncertainty

Exports offer a possible outlet for surplus production. Indian manufacturers have increased shipments to the United States, especially after trade restrictions affected other suppliers.

However, export growth depends heavily on international policy stability. The European Union and the United States are both strengthening domestic solar manufacturing through their own incentive programmes.

Trade analysts warn that reliance on exports alone may not fully absorb India’s excess capacity. Competitive pricing and technological upgrades will be critical.

“India has an opportunity to become a reliable alternative supplier,” said an analyst at Fitch Solutions. “But it must compete on cost, quality, and scale.”

Technology Transition Adds Pressure

Another factor shaping the solar manufacturing capacity glut is rapid technological change. The industry is shifting toward higher-efficiency technologies, such as TOPCon and heterojunction (HJT) modules.

Manufacturers that invested in older technologies may need additional capital to upgrade lines. If demand shifts quickly toward advanced products, outdated facilities risk becoming underutilised. This technological race adds financial strain at a time when margins are already compressed.

Rooftop Solar and Distributed Demand

India’s rooftop solar segment remains underdeveloped compared to its utility-scale projects. Expanding rooftop adoption could help absorb excess module capacity.

The government recently renewed focus on residential rooftop solar through targeted subsidy programmes. Industry experts say sustained policy clarity and simplified net metering rules are essential to unlock demand.

If rooftop installations grow steadily, they could improve domestic absorption of manufactured modules.

Environmental and Strategic Implications

The solar manufacturing capacity glut also has strategic implications. India aims to reduce dependence on imported energy equipment and strengthen energy security.

Building domestic capacity is central to that goal. However, if oversupply leads to bankruptcies or stalled investments, the long-term objective of self-reliance may weaken.

Environmental analysts argue that lower prices could accelerate solar adoption, supporting India’s climate commitments under the Paris Agreement. Yet they stress that quality standards must remain high to avoid long-term reliability issues.

Prospects of Consolidation

Industry observers expect consolidation if financial stress continues. Larger conglomerates with diversified operations may acquire smaller firms.

Consolidation could stabilise prices and improve operational efficiency. It may also encourage greater vertical integration across the value chain.

The International Energy Agency notes that solar manufacturing globally has experienced similar consolidation cycles following rapid expansion phases.

Policy Adjustments and Industry Dialogue

Government officials have indicated they are reviewing market conditions. Industry associations have suggested linking future manufacturing incentives more closely with verified demand pipelines.

Some analysts propose a phased approach to capacity approvals. Others argue for accelerated solar deployment through faster tendering and grid expansion. The balance between industrial policy and market demand remains delicate.

Related Links

Managing Growth with Stability

India’s solar expansion remains a cornerstone of its energy transition. The rapid rise in manufacturing capacity demonstrates strong investor confidence and policy support.

Yet the solar manufacturing capacity glut reveals the challenges of scaling too quickly. Falling prices support developers and consumers, but prolonged margin pressure threatens manufacturers.

The coming years will determine whether India can align supply growth with deployment, upgrade technology, expand exports, and maintain financial stability. If managed carefully, the current imbalance may become a transitional phase rather than a structural setback.